- Why 65 should no longer be the target retirement age

- Concurrent Hires David Montgomery from OneDigital to Head Retirement Plan Division

- 5 Southern States Where $750,000 in Retirement Savings Lasts Longest

- 7 Reasons I Wish I Used a Financial Advisor To Plan For Retirement

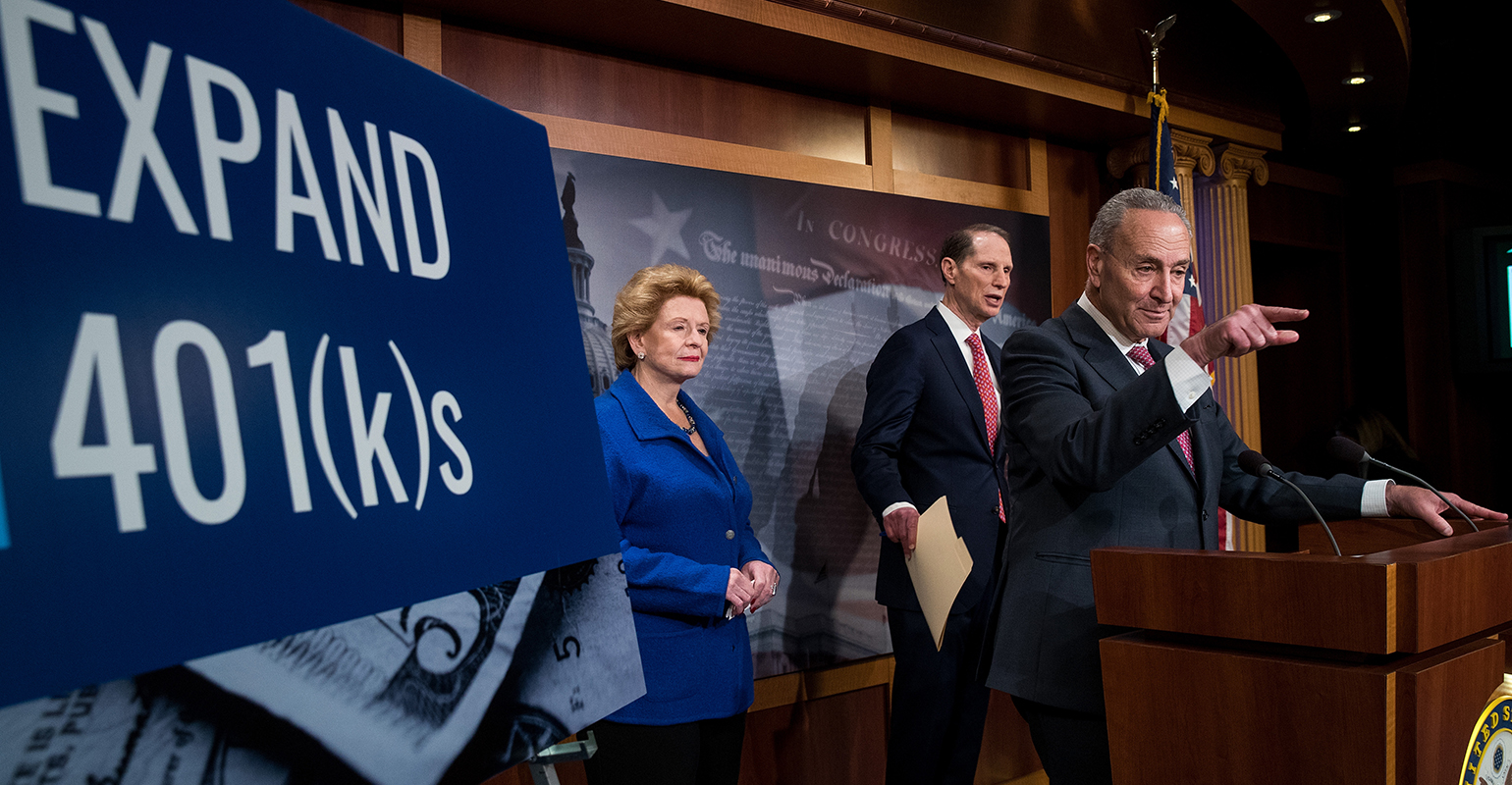

- Should the U.S. Government Create a Nationwide Retirement Savings Plan?

The Internal Revenue Service has issued proposed regulations addressing certain SECURE 2.0 Act provisions, including a provision generally requiring newly established 401(k) and 403(b) plans to automatically enroll eligible employees beginning with the 2025 plan year.

Bạn đang xem: IRS Proposes Regulations on Employer Retirement Plans

In general, unless an employee opts out, a plan must automatically enroll the employee at an initial contribution rate of at least 3% of the employee’s pay and automatically increase the initial contribution rate by 1 percentage point each year until it reaches at least 10% of pay.

Xem thêm : Report Maps How Changes to Social Security Affect Decisions to Retire

This requirement generally applies to 401(k) and 403(b) plans established after Dec. 29, 2022, the date the SECURE 2.0 Act became law, with exceptions for new and small businesses, church plans, and governmental plans.

The proposed regulations provide guidance to plan administrators for properly implementing this requirement and are proposed to apply to plan years that begin more than six months after the date that final regulations are issued. Before the final regulations are applicable, plan administrators must apply a reasonable, good faith interpretation of the statute.

Public comments on the proposed regulations may be submitted through the Federal Register, which is set to officially publish the proposed rules on Tuesday. A public hearing has been scheduled for 10 a.m. on April 8.

A draft copy of the proposed regulations can be found here.

Xem thêm : Financial Confidence? It’s Just Good Planning, Boomers Say

Separately, the IRS also proposed regulations that provide guidance relating to the increased catch-up contribution limit under the SECURE 2.0 Act, which are the additional contributions under a 401(k) or similar workplace retirement plan that generally are allowed with respect to employees who are age 50 or older.

This includes proposed rules related to a provision requiring that catch-up contributions made by certain higher-income participants be designated as after-tax Roth contributions.

The proposed regulations also provide guidance relating to the increased catch-up contribution limit under the SECURE 2.0 Act for participants between the ages of 60-63 and employees in newly established SIMPLE plans.

Public comments on the catch-up contribution rules remain open through March 14 and a public hearing has been scheduled for April 7.

Nguồn: https://factorsofproduction.shop

Danh mục: News

Leave a Reply