- UnitedHealth agrees to pay $69M in 401(k) ERISA class action

- Court Denies James Howells’ Bid for $770 Million Bitcoin Hard Drive (10/01/2025)

- You’ve Already Saved for Retirement. (Great!) But You Need a Withdrawal Plan, Too

- Retirement planning: Why it's so hard to do

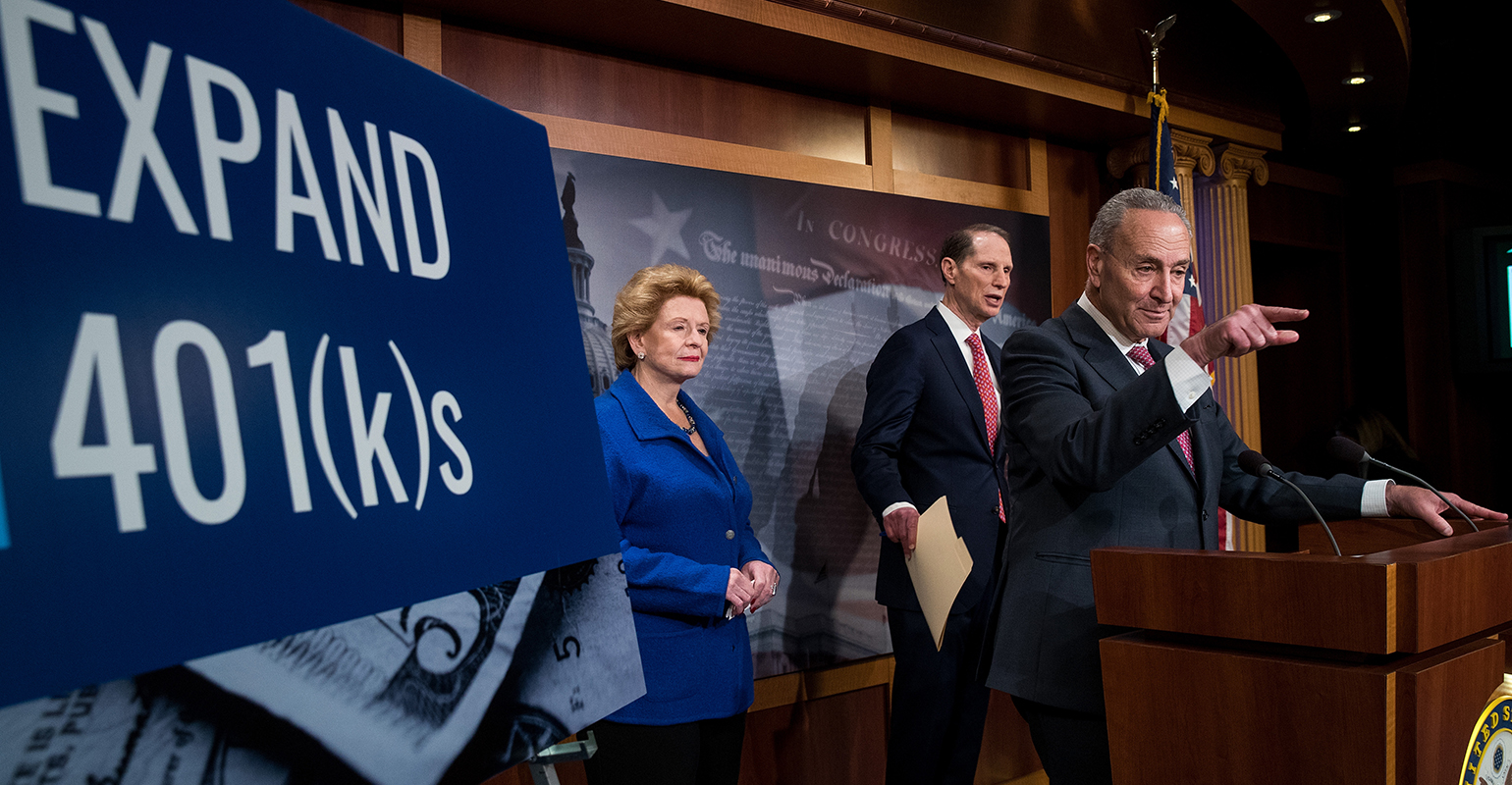

- New bipartisan bill seeks to simplify retirement savings for seniors

For an individual retirement account (IRA), the standard cap for the 2025 tax year is $7,000. But if you are 50 or older, you can make a catch-up contribution of up to $1,000, for a total of $8,000. The limits are the same as in 2024 — and if you haven’t yet maxed out your contribution for 2024, you still can; the deadline is April 15, 2025.

Bạn đang xem: Biggest Retirement Changes Coming in 2025

Contribution limits are going up for people with workplace retirement plans. In 2025, those ages 50-plus can put up to $31,000 into a 401(k), 403(b) or Thrift Savings Plan (and most 457 plans). That’s $500 above the 2024 cap. The limit for workers 49 and younger ticks up from $23,000 to $23,500 in 2025.

4. ‘Super catch-up’ contributions

Starting in 2025, workers near retirement age can put even more into employer-sponsored retirement plans. The so-called ”super catch-up” contribution enabled by the SECURE 2.0 Act, a 2022 federal law designed to help U.S. workers save more, goes into effect Jan. 1.

Xem thêm : Suze Orman’s Retirement Tips — 6 Pieces of Money Advice You Shouldn’t Ignore

Under this provision, savers ages 60 through 63 can make bigger catch-up contributions than other 50-plus workers: up to $11,250 over the standard limit, for a total of $34,750.

Early-60s workers can make super catch-up contributions to a 401(k), 403(b), governmental 457 or Thrift Savings Plan. The super catch-up is indexed to inflation and may increase year to year.

5. RMDs

People ages 73 and older must make annual minimum withdrawals from traditional IRAs and workplace retirement plans. Roth IRAs and workplace accounts are exempt from these required minimum distributions, or RMDs, as long as the original account owner is alive.

The IRS calculates your RMD based on the account balance and your life expectancy. You’ll owe federal income taxes on the withdrawal, at your regular tax rate. If you turned 73 in 2024, you have until April 1, 2025, to take your RMD; otherwise, the deadline is Dec. 31, 2024.

Xem thêm : How One RIA Unlocked Growth by Outsourcing Investment Management

New RMD rules taking effect in 2025 will affect some heirs who inherit an IRA. These beneficiaries typically must make minimum annual withdrawals but until 2025 have been able to spread them out over their lifetime. Starting Jan. 1, IRA inheritors other than a spouse — such as a child, sibling or a close friend — have 10 years to deplete the account.

This 10-year rule was part of a 2019 federal law on retirement savings but the IRS delayed implementation for several years. It applies to beneficiaries of accounts whose original owner died on or after Jan. 1, 2020. (Surviving spouses, in most cases, still have their full lifetime to empty an inherited account.)

6. Standard tax deduction

Most taxpayers take the standard deduction rather than itemizing their tax returns, and taxpayers ages 65 and up get to take a little bit more out of their taxable income. The IRS annually adjusts the amounts for inflation.

Here are the regular standard deductions for 2024 tax returns (the ones you must file by April 15, 2025):

- Married couple filing jointly: $29,200 (up from $27,700 in the 2023 tax year)

- Single or married filing separately: $14,600 (up from $13,850)

- Head of household: $21,600 (up from $20,500)

Nguồn: https://factorsofproduction.shop

Danh mục: News

Leave a Reply