- This Is the Average Social Security Benefit for Age 75

- Trump Coin Under Scrutiny: Coffeezilla Raises Red Flags About Token Distribution and Market Manipulation Risks

- Cross-border retirement plans could give Hongkongers access to cheaper healthcare: experts

- Concurrent taps OneDigital’s David Montgomery to lead retirement business

- How to start retirement planning early and avoid mistakes

Personal Finance

One of the trickier obstacles to handle when retiring with a sizable nest egg of retirement funds is dealing with taxes. While finally getting the chance to enjoy life and the fruits of scrimping, saving, and sacrifice without the obligations of a regular job is a prospect few would pass up, a strategy to minimize taxes ensures that the government won’t take more off the top than it is legally entitled to.

Paying One’s Fair Share of Tax, Not More

A 62-year-old and his 58-year-old wife recently posted on Reddit with this exact problem. He enjoys his job, which pays $180,000 annual salary. His employer contributes $22,000 per year to his 401-K plan, and the poster contributes $30,000 annually to his personal Roth 401-K. His wife retired in 2021 with a $70,000 per year pension and her own 401-K. They also have two rental properties, which generate a net $2,000 per month passive income.

While he would like to join his wife in retirement when he hits 63, he has tax concerns. His financial planner does not advise on taxes. With his company 401-K at $4.3 million, his Roth 401-K at $400,000, and his wife’s 401-K sitting at $2.2 million, the couple’s additional liquid $2.5 million investments are untouched. Between his $180,000 salary, his wife’s $70,000 pension, and their $24,000 rental income, their earnings and investments continue to outstrip their expenditures. The financial planner even advised spending more, and the couple has taken some pricier vacations and purchased new, luxury cars.

A snapshot of their assets, earnings, and liabilities shows the following:

|

Asset or Income Type

|

Amount

|

Tax Status

|

|

Husband’s 401-K (+$22,000 contribution annually)

|

$4,300,000

|

Deferred

|

|

Husband’s Roth 401-K (+$30K contribution annually)

|

$400,000

|

Paid

|

|

Wife’s 401-K

|

$2,200,000

|

Deferred

|

|

Wife’s Pension (w/2% COLA)

|

$70,000/year

|

taxable

|

|

Husband’s salary

|

$180,000/year

|

taxable

|

|

Liquid Investments

|

$2,500,000

|

Cap gains taxable

|

|

Rental Income

|

$24,000/year

|

taxable

|

|

Social Security (if taken at age 63)

|

$XX,000/year

|

taxable

|

Some Tax Strategies To Use While Enjoying Life

The couple in question has a number of choices they can make, depending on their long-term goals. Some strategies that they can consider for their situation include the following:

- Relocation – retirees often move to other states, like Florida, not only for the warmer climates, but also because Florida, Texas, Nevada, and some others have no state income tax. If the couple is in California or New York, the state and local taxes take a massive bite from income. Alternatively, some couples may relocate to another country with a much lower cost of living, such as Greece, Thailand, or Portugal, but logistics and other concerns would take another article’s worth of information to cover.

- Reallocate contributions – The couple has no Health Savings Account. As this also is tax-deferred, the husband should cease contributions to his Roth 401-K and send them to a new HSA as pre-tax contributions.

- Turn a Hobby Into a Business – if the couple has any hobbies that they can claim as a business, it can afford them a number of tax benefits.

- 1) Expenses (transportation, materials, promotion, etc.) from the business are deductible and can potentially be pooled with other 1099 passive income to lower the overall net income taxable base amount.

- 2) Establishing another business prior to retirement with the IRS can justify the lower tax bracket post-retirement, thus reducing tax percentages.

- The IRS permits a company to take losses for 3 out of 5 years before declaring it a hobby or not. That gives a 5-year flexibility in deciding whether or not to close it down or to declare some profits in future years if warranted.

Portfolio Considerations

As the couple has a combination of both post-tax and tax-deferred investments, in addition to taxable income, they may wish to consider these measures:

- While the husband is still employed and the $2.5 liquid investments remain untouched, the couple might consider shifting a portion of the portfolio into tax-free municipal bond funds prior to retirement, since municipal bond coupon payments are tax-free. If they reside in a state with a state income tax, then a state-specific muni fund or bond portfolio will be double or triple tax-free, accordingly.

- Post-retirement, if any of the retirement funds are required, the post-tax Roth IRA account should be the first one to see withdrawals, along with the liquid investments, since the withdrawals will reduce capital gains tax amounts.

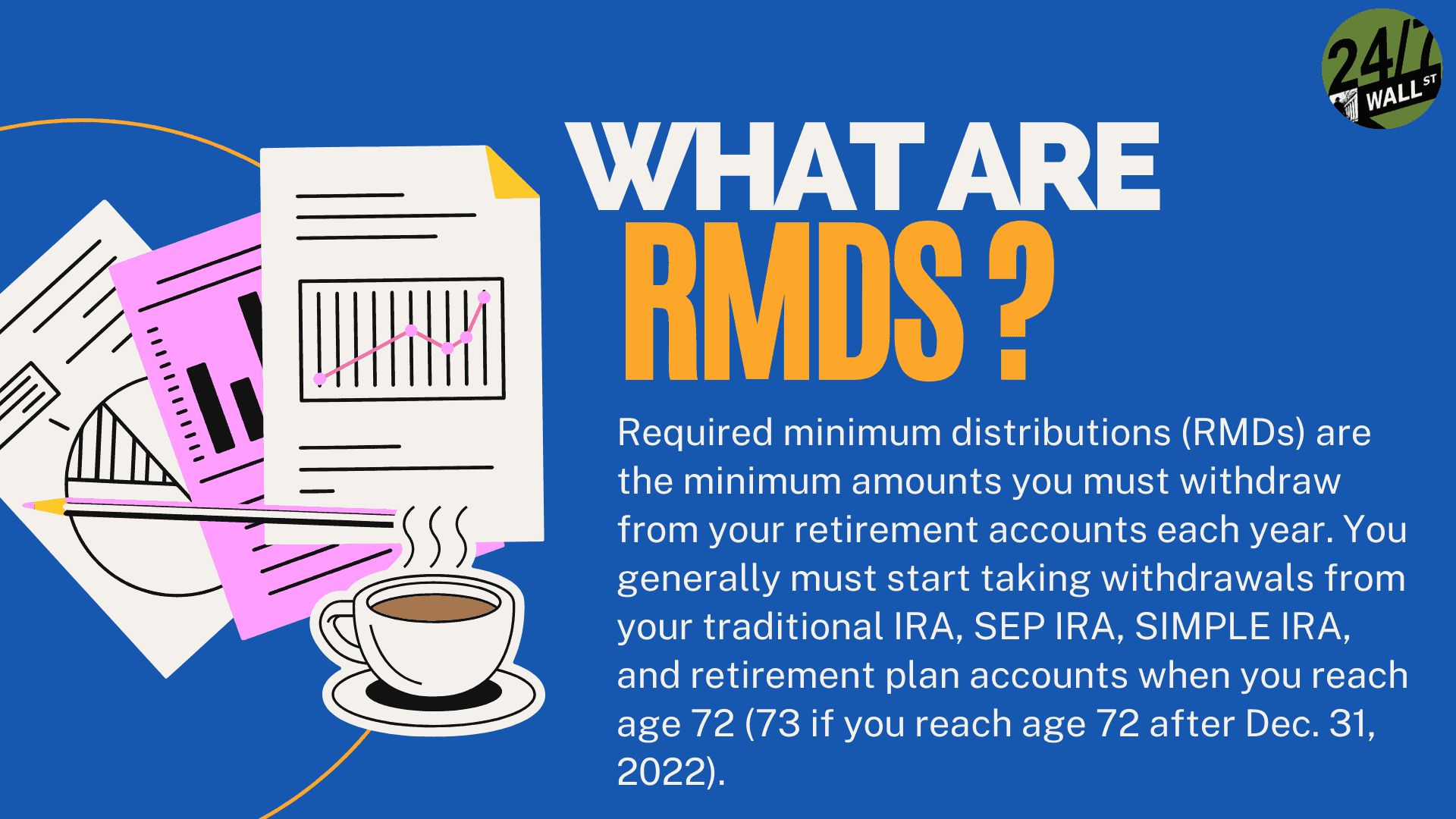

- The deferred tax accounts should be left to continue to grow for as long as possible until mandatory required minimum distribution regulations are triggered at age 72.

This article should be considered as opinion only. Those seeking retirement planning and tax advice should seek counseling from a financial or accounting professional.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

Nguồn: https://factorsofproduction.shop

Danh mục: News

Leave a Reply